4 Simple Techniques For Bankruptcy Lawyer Tulsa

Table of ContentsTulsa Bankruptcy Consultation for DummiesSome Known Details About Top-rated Bankruptcy Attorney Tulsa Ok Chapter 7 Vs Chapter 13 Bankruptcy Fundamentals ExplainedHow Tulsa Bankruptcy Legal Services can Save You Time, Stress, and Money.The 8-Second Trick For Tulsa Bankruptcy AttorneyTop Guidelines Of Tulsa Debt Relief Attorney

Individuals have to use Phase 11 when their financial obligations go beyond Phase 13 financial obligation restrictions. It rarely makes feeling in other circumstances however has much more options for lien stripping and cramdowns on unprotected parts of safe financings. Chapter 12 insolvency is developed for farmers and anglers. Chapter 12 settlement strategies can be more versatile in Phase 13.The ways test checks out your typical monthly income for the 6 months preceding your filing date and contrasts it versus the mean revenue for a similar family in your state. If your revenue is listed below the state average, you automatically pass and do not have to finish the whole form.

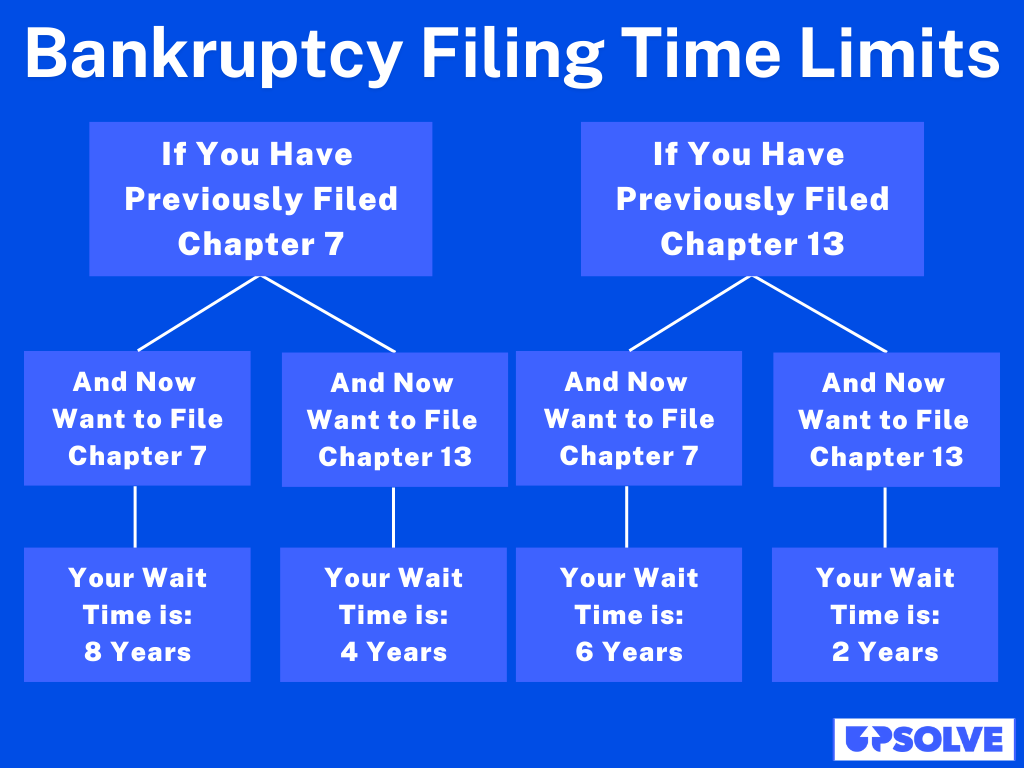

The financial debt restrictions are detailed in the chart above, and present quantities can be validated on the United State Courts Phase 13 Personal bankruptcy Essential web page. Find out more regarding The Way Test in Phase 7 Bankruptcy and Financial Obligation Limits for Phase 13 Bankruptcy. If you are wed, you can apply for personal bankruptcy collectively with your partner or separately.

Declaring bankruptcy can aid a person by throwing out debt or making a strategy to pay off financial obligations. An insolvency situation usually begins when the borrower submits a petition with the personal bankruptcy court. There are different types of insolvencies, which are normally referred to by their chapter in the United state Insolvency Code.

If you are facing monetary challenges in your individual life or in your organization, possibilities are the idea of declaring bankruptcy has actually crossed your mind. If it has, it additionally makes feeling that you have a great deal of insolvency inquiries that require solutions. Lots of people actually can not answer the question "what is insolvency" in anything other than basic terms.

If you are facing monetary challenges in your individual life or in your organization, possibilities are the idea of declaring bankruptcy has actually crossed your mind. If it has, it additionally makes feeling that you have a great deal of insolvency inquiries that require solutions. Lots of people actually can not answer the question "what is insolvency" in anything other than basic terms.

A Biased View of Tulsa Bankruptcy Consultation

Chapter 7 is termed the liquidation insolvency phase. In a chapter 7 bankruptcy you can eliminate, wipe out or discharge most kinds of debt.

Numerous Chapter 7 filers do not have a lot in the means of properties. They might be renters and have an older auto, or no automobile in all. Some live with parents, pals, or brother or sisters. Others have homes that do not have much equity or remain in major requirement of repair work.

Creditors are not enabled to go after or keep any kind of collection activities or claims during the situation. A Phase 13 personal bankruptcy is extremely effective because it offers a mechanism for borrowers to protect against Tulsa bankruptcy attorney repossessions and constable sales and quit repossessions and energy shutoffs while capturing up on their secured financial obligation.

All About Chapter 13 Bankruptcy Lawyer Tulsa

A Phase 13 case might be useful in that the borrower is permitted to obtain captured up on home loans or auto loan without the hazard of repossession or foreclosure and is enabled to keep both exempt and nonexempt residential or commercial property. The debtor's plan is a file detailing to the personal bankruptcy court just how the borrower suggests to pay present costs while paying off all the old debt balances.

It offers the borrower the possibility to either sell the home or come to be caught up on mortgage settlements that have actually fallen behind. An individual submitting a Phase 13 can recommend a 60-month strategy to heal or become present on mortgage bankruptcy lawyer Tulsa payments. If you fell behind on $60,000 well worth of home mortgage payments, you can propose a plan of $1,000 a month for 60 months to bring those home loan payments existing.

It offers the borrower the possibility to either sell the home or come to be caught up on mortgage settlements that have actually fallen behind. An individual submitting a Phase 13 can recommend a 60-month strategy to heal or become present on mortgage bankruptcy lawyer Tulsa payments. If you fell behind on $60,000 well worth of home mortgage payments, you can propose a plan of $1,000 a month for 60 months to bring those home loan payments existing.

How Experienced Bankruptcy Lawyer Tulsa can Save You Time, Stress, and Money.

Occasionally it is much better to stay clear of bankruptcy and clear up with lenders out of court. New Jacket also has an alternative to bankruptcy for companies called an Assignment for the Advantage of Creditors and our regulation company will review this choice if it fits as a potential approach for your service.

We have actually developed a device that assists you choose what chapter your documents is most likely to be filed under. Click right here to make use of ScuraSmart and discover a possible option for your debt. Lots of people do not understand that there are numerous kinds of personal bankruptcy, such as Phase 7, Chapter 11 and Phase 13.

Below at Scura, Wigfield, Heyer, Stevens & Cammarota, LLP we deal with all kinds of insolvency cases, so we have the ability to address your insolvency concerns and assist you make the very best decision for your situation. Right here is a quick take a look at the financial debt alleviation alternatives offered:.

The 8-Minute Rule for Top-rated Bankruptcy Attorney Tulsa Ok

You can only file for personal bankruptcy Prior to filing for Chapter 7, at least one of these need to be true: You have a lot of financial debt revenue and/or assets a lender could take. You have a great deal of financial debt close to the homestead exception amount of in your home.

The homestead exemption amount is the better of (a) $125,000; or (b) the county median list price of a single-family home in the preceding fiscal year. is the amount of money you would keep after you sold your home and paid off the home mortgage and various other liens. You can locate the.

Comments on “What Does Tulsa Ok Bankruptcy Attorney Do?”